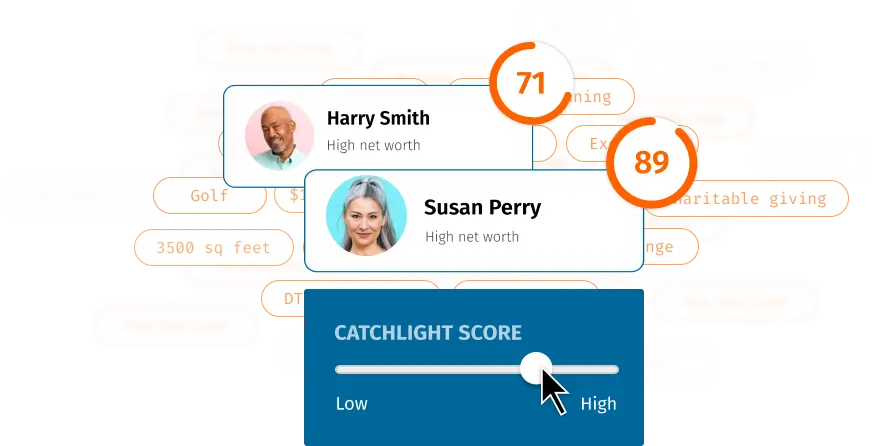

Catchlight enriches a lead profile with:

✅ Estimated Investable Assets

✅ Estimated Income Range

✅ Life Events (e.g., received company stock, looking for job change, home purchase)

✅ Hobbies & Personal Interests

✅ Financial Interests (e.g., charitable giving, career development)

✅ Additional behavioral insights to improve lead engagement

This information helps financial advisors craft personalized outreach strategies and nurture leads more effectively.