Managing finances is a meticulous and tedious process. It requires operational efficiency and accuracy. It is pivotal to understand the twists and turns of this business and carefully adopt optimizing practices. However, you can’t always predict the outcome of your strategies, and blindly throwing arrows in the dark for what might work is neither practical nor scalable. This is why, you should opt for a system that accurately analyzes and evaluates the health of your financial advisory firm and provides you with actionable statistics.

With the ever-evolving monetary structures and complex calculations, it is paramount to measure the health of your company. It enables you to view all the operations being carried out within your organization and empowers you to make the best business decisions.

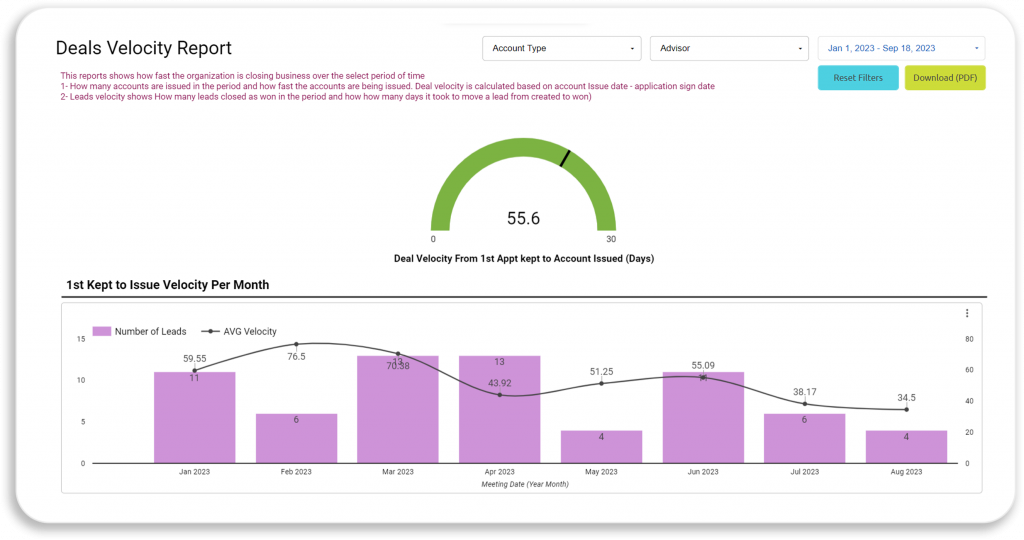

In this context, LeadCenter offers an intelligent solution with its Deals Velocity Report. This report allows you to assess, analyze, and optimize the operational efficiency of your organization.

In the simplest terms, deal velocity refers to the speed of finalizing deals with clients. To run a successful financial advisory practice, you need real-time data updates. This is exactly what the Deals Velocity Report provides. It presents a deeper look into your company’s ability to deliver value to clients. It is a comprehensive tool that evaluates the operational health of your organization and empowers you to meet your business goals.

The Deals Velocity Report tracks several KPIs that indicate your company’s capabilities. These metrics provide a detailed view of the functioning of your financial advisory practice and prompt you to enhance your bottom line.

Let’s take a look at the metrics tracked by the Deals Velocity Report:

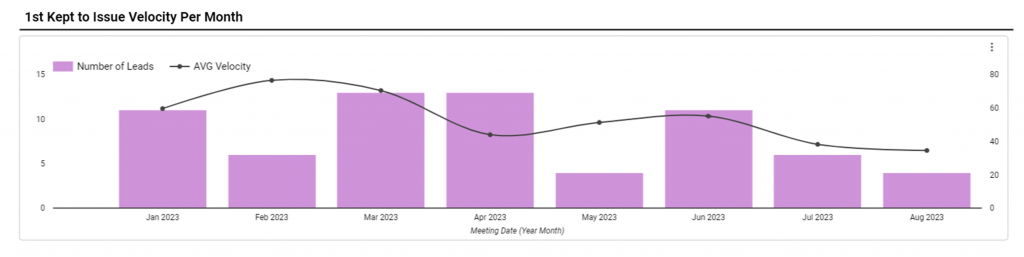

This metric shows the time it takes from the first appointment with the lead to when there's an account issued for a new client. This first meeting with the client determines your ability to swiftly convert a lead into a paying client.

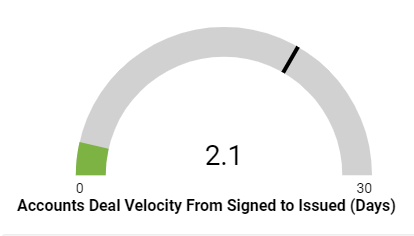

This metric shows the speed with which signed agreements turn into investable assets issued by the clients. It shows how you educate, inform, and train your clients throughout the onboarding process and direct them to take the desired action.

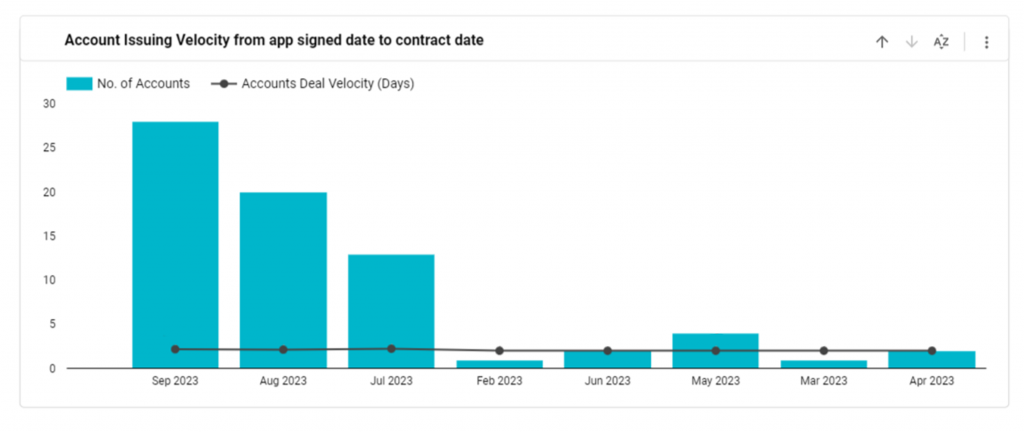

This metric indicates the duration between signing an application and finalizing a contract. It enables you to manage paperwork and eliminate any blocks causing delays.

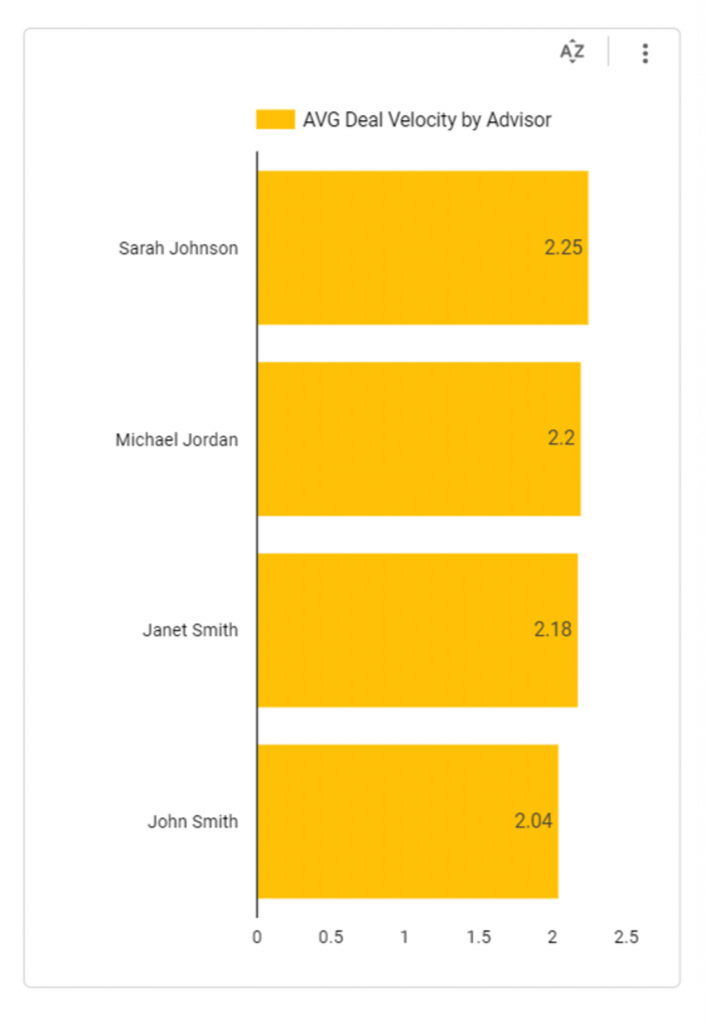

This metric allows you to monitor individual advisor performance. You can implement improvement processes to help advisors who take longer than usual to close deals.

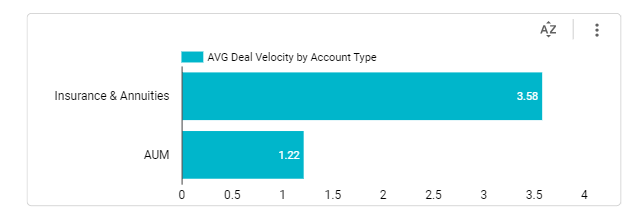

This metric evaluates the speed of processing different account types for your clients. Using insights from this metric, you can streamline workflows for all account types.

While these metrics indicate your organization’s operational efficiency, there is more to each of these metrics beyond the surface. Let’s discuss how these metrics drive value for you and your clients:

Initial interaction with a lead can go either way. There’s no guarantee that a lead will even show up for the first meeting. However, when a lead does show up for the first call, it is up to you to put your best foot forward.

This is precisely why the first appointment kept is a critical metric to observe. Your speed of converting a lead into a client represents your expertise and is a reflection of your firm’s excellence.

After a successful initiation, you can lead your prospects to sign the application to proceed.

Now it’s time for you to follow up with your potential clients and streamline processes for them to issue the account.

When your client signs the application to issue the account, it’s up to you to grease the wheels on your administrative cart. An efficient administration will draw up a comprehensive contract, get it processed, and have the client sign it without any hitch.

It reflects your organization’s efficiency in carrying out regulatory tasks swiftly and with ease. The longer this process takes to get to the next step, the more it points towards administrative bottlenecks.

As a financial advisor, you interact with several prospects on a regular basis and are well aware of the ins and outs of your practice. Therefore, your interaction with a prospect aims to drive revenue. Your communication process is the key to converting leads into clients.

The speed with which you achieve that becomes an indicator of your excellence. By using this metric, you can implement an atmosphere of healthy competition among financial advisors and provide additional training for weak-performing advisors.

Every client is different and so are their financial planning needs. With different types of accounts to choose from, there is a different workflow for getting each one up and running smoothly.

You can tailor this process by averaging the time it takes to process each account.

It is critical to understand how Deals Velocity Report drives value for your organization. You can interpret this data by looking at the results.

Let’s discuss this:

When you observe that your deals velocity metrics indicate a shorter span of time than the average industry timeframe, it suggests that you’re playing at a higher level. Your company is swiftly converting leads into clients, processing transactions, and managing paperwork.

When the deals velocity metrics show an increase in time for closing deals, it indicates to an inefficient administration. This could lead to a loss of motivation among advisors and can negatively impact client engagement. Your next steps should be to investigate the problem, identify the weak areas, and implement a change in strategy.

Advisors’ performance is a crucial metric as it determines which of the financial advisors are closing deals faster than others. Using this metric, you can analyze the work processes and best practices of your top-performing employees and carve out a similar approach for others.

Certain account types take longer to process while others get processed swiftly. You can use this metric to address the specific needs of certain account segments and eliminate any disparities.

You can leverage the data gained from the Deals Velocity Report to optimize your processes, eliminate delays, streamline workflows, and enhance the overall performance of your organization.

Here’s how you can leverage this data for improvement:

Using this report, you can identify roadblocks preventing you from achieving your goals. For example, if you see a delay in administrative tasks, you can opt for automation and other digital solutions to optimize workflows.

With the insights on deal velocity, you can set up a standard based on the industry average or your company’s historical data. You can use these milestones to measure your company’s performance and implement changes accordingly.

By observing the advisors’ performance metrics, you can invest in additional training and development. This will help you retain a positively motivated workforce and promote an atmosphere of learning and growth.

The Deals Velocity Report provides you with real-time data to execute change. Instead of relying on assumptions, you can encourage a culture of using this data to observe patterns and predict behavior based on that.

Having an open communication channel with your team is crucial in driving value from these metrics. You can gather feedback, ask for suggestions, and share insights regarding improvements and enhancements.

The Deals Velocity Report is a powerful tool that is designed for financial advisors to assess and evaluate the health of their firms and take proper measures to enhance their operational integrity. It enables you to gather insights based on the speed at which you close deals. It presents empirical data to pinpoint your areas of improvement and empower you to make data-driven decisions. This report gives you a competitive edge over your rivals with continuous monitoring of your operations and helps you stay agile with the changing times.

The Deals Velocity Report updates data in real time. As soon as you enter new information, the system processes it and reflects it within the report. For example, when you acquire a new account, this report will record the time and date of this entry and will also show the average number of days it took you to finalize this type of account.

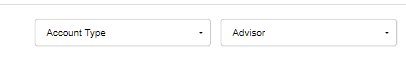

Yes, you can! The Deals Velocity Report offers customization as required. The filters on top help you focus your search by advisor and account type.

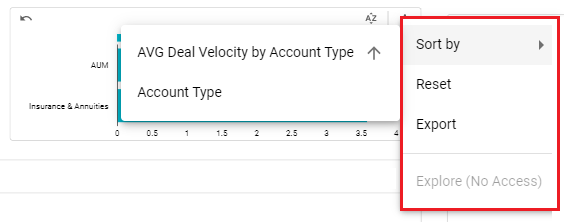

Moreover, you can click on the three-dot menu on the right side of the graphs to pinpoint your search and get the required results.

The Deals Velocity Report helps you: