To foster a growth environment and maintain a positively motivated advisor workforce, it is crucial to calculate, track, and disburse advisors’ commissions accurately.

Accurate commission tracking provides financial advisors and management with valuable insights into what products or services are generating the most revenue. It helps you make data-driven decisions, and strategically allocate resources.

Digital evolution has enveloped the financial advisory industry in the best way possible. This industry's calculative and fast-paced operations require the proper use of automation to ensure efficiency and accuracy. Thus making it all the more significant to set up commissions for financial advisors and automate calculating commissions.

This calls for a robust and innovative system that automates individual advisor commission and payment tracking for insurance products and annuities. This is what LeadCenter offers with its Commissions setup. It calculates, tracks, and distributes commission payments based on specific criteria. Additionally, the integration with Redtail CRM allows for enhanced data management within the two platforms.

Let’s delve deeper into the subject matter and see how automation has revolutionized the financial advisory industry:

As a financial advisor, you’ve experienced the limitations and challenges of manual commission tracking. You’ve had to make use of the Excel sheets for recording data. It might work for a business structure with repeated tasks. However, a financial advisory firm is far from that concept. Here’s where you can go wrong with such outdated methods of commission tracking:

Automation has revolutionized the commission tracking environment for insurance products and annuities. The commission structures for insurance products and annuities are complex and traditional methods aren’t sophisticated enough to handle them. Whereas, automation enables you to correctly calculate commissions, update compensation structures, and track efficiency. In addition, automated systems provide real-time reporting and advanced analytics to keep you up-to-date and help you make informed decisions based on statistics.

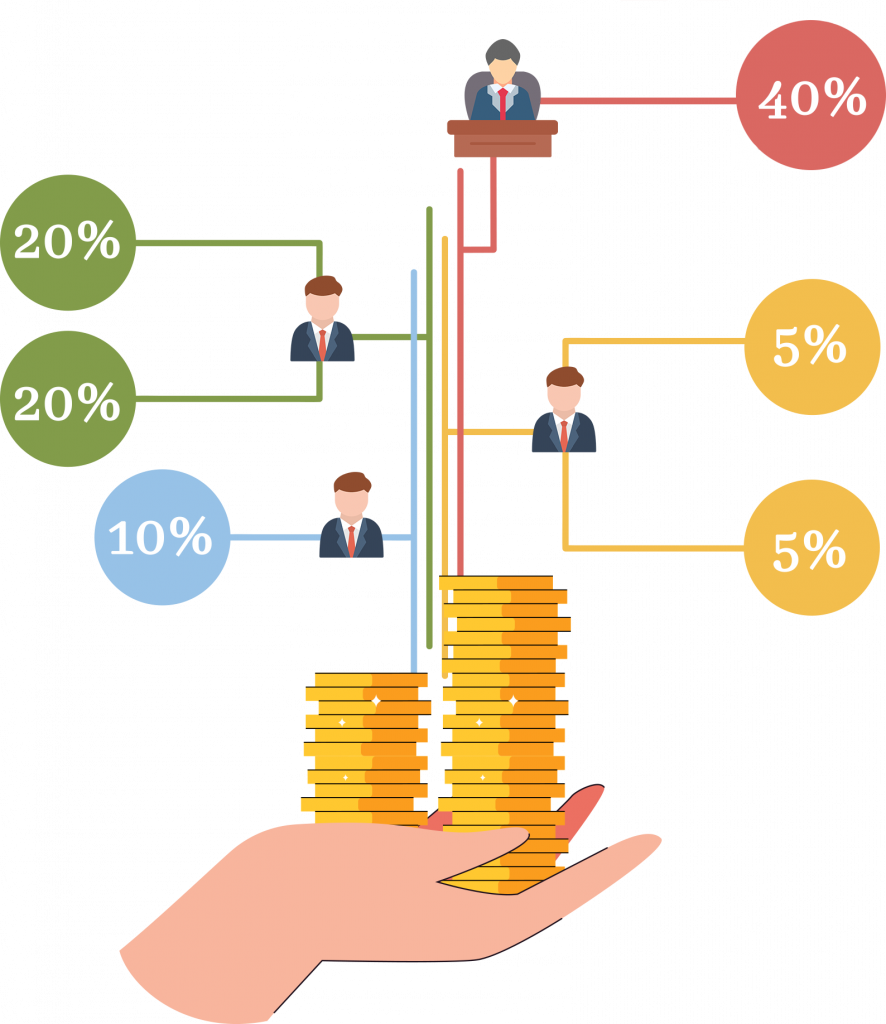

One of the biggest challenges financial advisory companies face is efficiently managing the compensation process for all financial advisors on board. Traditionally, this process required manual labor and consumed time. This method is also prone to errors and inconsistencies.

However, automation helps eradicate these discrepancies and enables you to streamline the compensation process.

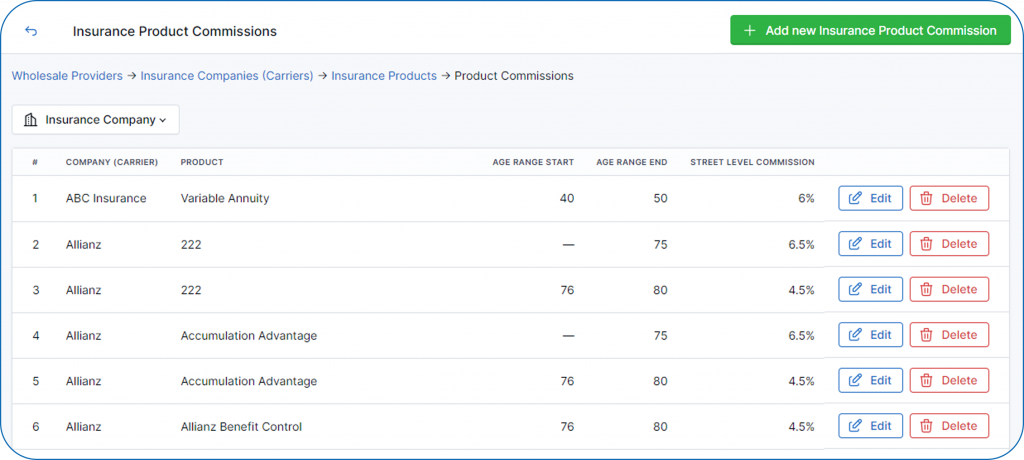

LeadCenter offers configuring commissions for annuities and insurance products. You can set up different insurance products and record the commission percentage for that product.

Our platform is purpose-built to handle the business needs of financial advisory firms. From organized lead management to real-time reporting and advanced analytics, you can streamline your sales and marketing activities.

LeadCenter enables you to configure commission plans for financial advisors. You can create customized commission plans for different advisors and set up different compensation rates for each plan.

LeadCenter offers various intuitive features such as configuring insurance products and the commission for these products. You can set up ranges, street level commission for the selected product, and LeadCenter will automatically configure compensation rates for the writing advisor based on that.

In addition to configuring commission plans, you can access these reports for a better understanding of your daily operations and gain insights;

Once you’re done with the configuration of your LeadCenter account, the system will configure the commission settings for all the accounts. It’ll save you bouts of time otherwise spent on tracking and recording commissions.

You can better spend this time on client interaction, carving out an intricate business strategy, and focusing on core business goals.

Manual data entry requires a person to do a job and raises the risk of human error simultaneously. Automation eliminates the need for manual labor and the risk of data inconsistencies.

Automating commission calculations ensures transparency and fosters trust between the organization and employees.

Once you’ve acquired a client’s account, all the relevant information will be reflected throughout the platform. You can use this information to create commission plans and add employees to a plan of your choice. For example, you can have separate commission plans for full-time financial advisors on board and part-time contractors.

The automated compensation structures allow advisors and management to view real-time results. This fosters an atmosphere of motivation and positive attitude among financial advisors and enables them to grow. By keeping a check on each financial advisor’s contribution to the company, you can leverage their capabilities and empower them to hone their skills.

By having a dynamic view of the commission generated by different employees, you can gain insights into your company's financial performance, and identify potential areas for improvement. Thus, helping you conduct effective internal audits and make better business decisions.

Automating the commission plan enables you to update the commission rules according to the evolving market trends and growing business needs. You can configure different commission plans for different teams within your organization and set up desired compensation rates. Moreover, automated systems are highly adaptable. It will efficiently accommodate any upcoming changes based on predictive behavior and keep up with changing market needs.

LeadCenter seamlessly integrates with Redtail CRM. This integration enhances your efficiency and streamlines your workflows. It enables you to sync insurance and annuities accounts and push the contact’s financial information to Redtail.

To summarize, automation is the present and the future of the financial advisory industry. You can take a step in the right direction by automating workflows. Automation enables you to optimize compensation management methods and empower financial advisors to focus on advanced business goals.

For a more detailed understanding of how commissions tracking works, refer to our knowledgebase articles:

Automating tracking commission ensures data consistency, helps you track each financial advisor’s contribution, and enables you to compensate them accordingly.

LeadCenter presents collaborative features that help you streamline the compensation process by:

LeadCenter seamlessly integrates with Redtail and enhances data management by:

Yes! You can create customized commission plans based on each advisor’s contribution and set up their compensation rates accordingly. To create a new commission plan and add employees to it, refer to our knowledgebase article Configuring Commissions.

Automating commission plans helps you better understand the financial performance of your organization. You gain insights into your employees’ contributions and tailor the commission structure based on that. This leads to an effective decision-making strategy based on statistics.

Scalability allows you to configure various workflows without compromising performance. It ensures consistent management of the system, streamlines workflows, and drives growth.

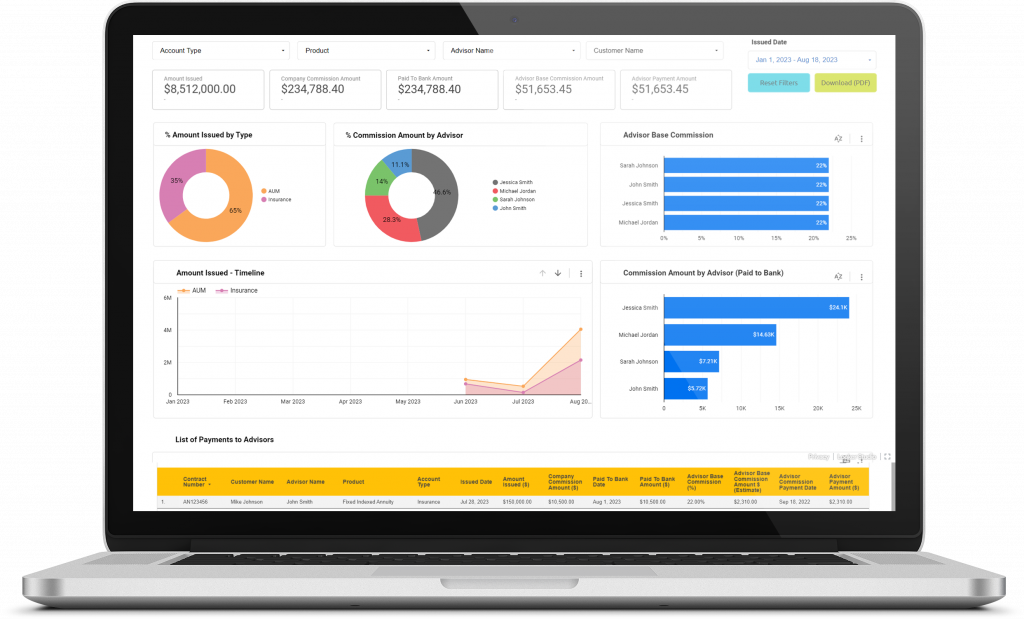

This dashboard gives you a detailed report of advisors’ KPIs. You can see the commission generated by each advisor represented by graphs and charts. This helps you access commission-related information all in one place.

Yes! You can go to the Financial Accounts dashboard and view client accounts’ data in one place. The filters on this dashboard help you enhance search capabilities and show you the required results. You can see all the client accounts in a tabular format with all the information regarding the amount, advisor, insurance products, account type, etc.