The financial advisory industry is on the verge of digital uphaul. Technological advancements have made a significant impact on the processes and functions of financial management. LeadCenter has always been at the center of this digital evolution. This platform is purpose-built for financial advisory firms and caters to their requirements with innovative solutions. These innovative solutions involve but are not limited to:

One of these processes is gathering client information and collecting data. Initially, this data collection was manual and required a thorough interaction with the client to understand their needs better and then craft a financial plan for them. However, this process is time-consuming, requires manual data entry, and is overall tedious. This emerges as a challenge for financial advisors globally.

After receiving requests from almost 120 financial advisors via online forums, LeadCenter team started developing a unique financial questionnaire form with a secured public link to send to contacts. Its sole purpose is to offer convenience to financial advisors and their prospects and bring about the much-needed and requested change through digital innovative solutions.

The traditional methods of data collecting are tiresome and hold a higher risk of inconsistencies. To top it off, people exhibit a lower attention span and can easily drift away from something that feels monotonous. On the other hand, financial advisors need to close deals and acquire client accounts as fast as possible, which means they need to have accurate client information before they have a first appointment with a client. Let’s see the inherent inefficiencies of opting for the traditional data-gathering methods:

Financial management relies heavily on verified documentation such as tax documents, investment portfolios, income statements, bank statements, and much more.

Both the client and financial advisor had to go through this mountain of paperwork to get all the information. Not only does it frustrate the clients but is also a logistical nightmare for financial advisors to keep track of every client’s financial records in physical documents.

One of the biggest challenges of manual data collecting or entering is its higher susceptibility to human error.

People make mistakes and in the case of managing finances, it is much more likely that you mess up numbers and create discrepancies in the financial portfolio of a client. This could lead to a huge disaster as wrong calculations lead to significantly inaccurate financial plans.

For every business, time is the most valuable asset. The same goes for a financial advisory firm.

However, managing a client’s finances requires you to spend countless hours entering data into Excel sheets, cross-checking documents, creating checklists, and updating the database. You may also require additional staff members to help with this task. The traditional method is not only time-intensive but also uneconomical.

The physical records of client financial data are harder to safeguard. Traditionally, financial advisory firms invested in lockable cabinets, safes, and even additional security staff to keep their clients’ confidential data safe.

It makes for one more challenge of traditional data collecting and even with all the stops in place, the physical documents are prone to loss and damage.

Manually entering data takes an extensive amount of time. So much so that it creates a lag between gathering client information and crafting a sound financial plan.

This is due to the ever-evolving financial landscape. By the time, the advisors start analyzing the gathered information, the market trends may fluctuate, thus making their strategies obsolete.

This scenario calls for something that benefits both the client and the financial advisor.

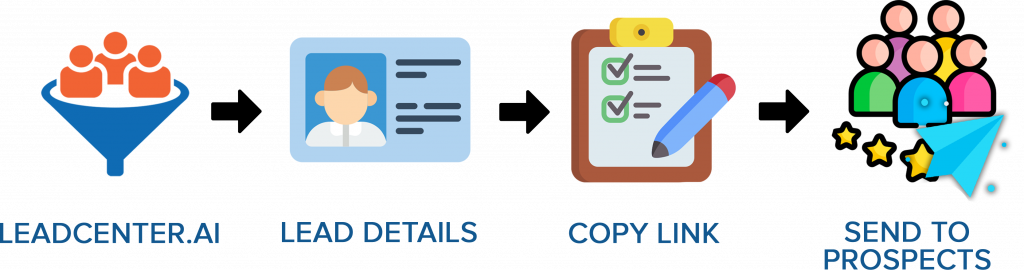

LeadCenter answered the call and introduced a Financial Questionnaire for the clients to fill in their information. A Financial Questionnaire is an online form that has a secured public link. You can send this link to new contacts/prospects to fill in their data, on their own time, and at their own pace. This form consists of various sections for prospects to populate their information. Some questions have checkboxes to choose more than one answer while some have Yes/No options. It depends on the kind of data that you require from your contacts.

Accessing the Financial Questionnaire and sending it to your prospects is as easy as pie. Just follow the steps given below:

As a financial advisor, you’re responsible for managing your client’s finances and giving them sound financial advice. All this requires a strong database and your ability to gather accurate information about your client.

Let’s explore the importance of your client’s financial details in parallel with the Financial Questionnaire:

The Financial Questionnaire is fairly detailed and addresses all aspects of your client’s financial history. The biggest advantage is that all questions have a set number of options to choose from. Your contacts can auto-populate their information and experience hassle-free data submission.

The comprehensive data gathering empowers you to make informed decisions and craft a tailored solution for your client. The Financial Questionnaire gathers information regarding your client's financial priorities, risk tolerance, and unique goals. This enables you to craft a strategy that aligns with your client’s specific requirements.

Without detailed client information, you’ll be doling out generic advice and failing to strategize accordingly. The Financial Questionnaire takes care of this problem by highlighting potential opportunities and identifying risks. You can use this to devise a smart strategy with clear targets such as savings or investment opportunities for your clients.

The Financial Questionnaire provides you with detailed client information along with your prospect’s complex financial situations. In this way, you can familiarize yourself with this prospect’s unique financial needs and prepare for a more meaningful interaction during your first appointment. With a deep understanding of your prospect’s financial requirements, you’re more likely to form a bond of mutual respect and trust.

Managing finances is a complex process. However, the Financial Questionnaire is simple, clear, and transparent. Your prospects populate their information, thus enabling you to simplify the more complex concepts of the financial world for them, and helping them make informed decisions. You can discuss in detail the challenges of their financial situation and devise proactive plans accordingly.

The Financial Questionnaire takes into account unforeseen circumstances and gathers critical information. This information includes life events, economic shifts, and market trends. It enables you to craft a course of action if and when there’s a change in the financial landscape. This is how you can stay ahead of changing circumstances and ensure adaptability.

LeadCenter offers the Financial Questionnaire as an innovative and convenient solution to financial advisors and their clients.

Let’s see some of the benefits of using the Financial Questionnaire.

Ever since the technological advancements in the financial advisory industry, financial advisors have been speaking out about having a form to send to their contacts.

Here’s how the Financial Questionnaire benefits advisors:

People want convenience. Nobody wants to be interrogated on their first appointment with a financial advisor.

A Financial Questionnaire brings certain benefits for the prospects:

A satisfactory client experience is the ultimate goal of any business. Taking all the complexities of the financial management system into account, the LeadCenter team wanted to create something to act as a bridge between financial advisors and their clients. This is precisely what a Financial Questionnaire achieves. Here’s how this works.

Before the very first meeting (virtual or in-person), you, the financial advisor, send the Financial Questionnaire to the prospect. Now, two things happen. One, you can track your prospect’s progress as they submit answers to each section. Two, your prospect can take all the time in the world to answer the questions. You do not have this luxury during a meeting.

With a Financial Questionnaire, you and your prospect will be more than prepared to discuss the next steps instead of going over each aspect of their financial history. This creates a level of trust and reassurance for your prospect and translates into a positive client engagement experience.

The Financial Questionnaire is a robust feature that works harmoniously with the LeadCenter data management system. It doesn’t require a complicated setup or additional logins. It works as a strategic enhancement of the platform. When a prospect submits their financial data via the questionnaire, our automated system will parse this data and categorize it accordingly. Moreover, the reporting and analytics tools synchronize perfectly with the Financial Questionnaire feature. This synchronization results in valuable insights from the collected data.

The Financial Questionnaire is a robust feature of the LeadCenter platform which means that it integrates well with the Redtail CRM as well. You can harness the power of automation from both platforms using the questionnaire.

Here’s a brief recap of what we learned about the Financial Questionnaire:

To leverage the full potential of the Financial Questionnaire, refer to these resources:

The Financial Questionnaire serves multiple functions. However, its first and foremost purpose is to streamline the collection of clients’ financial data. The Financial Questionnaire acts as an online form that helps you auto-populate your financial information and keeps it secure in a protected digital environment. Its other purposes include:

The Financial Questionnaire is thoroughly detailed. It covers your client’s financial information such as tax statements, bank statements, investment portfolio, financial priorities, objectives, risks, and goals.

Yes, the Financial Questionnaire is highly secure. Each unique link ensures data security. It offers multi-layered security and multi-factor authentication to protect the confidentiality of your client's financial information.

The Financial Questionnaire offers a multitude of benefits for financial advisors. Here are a few:

The Financial Questionnaire has a user-friendly interface and an easy-to-follow format.

Yes, it does! In fact, it is an enhancement of the LeadCenter platform. It is developed for financial advisors to optimize the data collection process. Additionally, the questionnaire works in complete sync with the reporting and analytics tools and provides unique insights regarding the collected data.